Much like a punch-drunk boxer using the ropes for support rather than forward momentum, the global chemical industry enters 2010 in a defensive position, believing that the worst is over but wary of forecasting anything more than a very gradual recovery.

Battered by the deepest recession in its history, the chemical industries in Europe and the US are hoping that 2010 will bring modest growth following the stabilisation towards the end of last year. Prospects for the Asia-Pacifi c region are brighter, with forecast production growth rates signifi cantly higher and led by China and India – the only two major chemicals producing nations to avoid falls in output last year.

Down but not out

In Europe, output of chemicals, excluding pharmaceuticals, is expected to rise by 5%, according to the European Chemical Industry Council (Cefi c). It points to published production data and forward-looking business confi dence surveys as evidence that the bottom has been reached. ‘Most chemicals sectors in most major EU countries are seeing some recovery,’ says Cefi c in its latest review of the European chemicals industry.

However, it warns that a return to the peak output levels achieved during the fi rst quarter of 2008 is likely to take several years. ‘There is no sign of any major rebuilding of inventories by downstream customers, which suggests a prevailing mood of caution and continuing diffi cult credit conditions.’

The European chemical industry is operating far below its optimal capacity utilisation level, says Cefi c, which in turn means lower production effi ciency and reduced margins. ‘On the other hand, it leaves the industry well placed to respond to higher demand once confi dence returns and downstream customers start to rebuild inventories. Everything considered, it is likely to be several years before previous peak output levels are regained.’

Cefic is doubtless right to be cautious about recovery prospects and its ability to forecast accurately European chemical industry output. In November 2008, Cefi c predicted that EU chemicals industry production, excluding pharmaceuticals, would decline by just 1.3% last year. It now expects 2009 output to be down by a massive 12%, compared with the previous year.

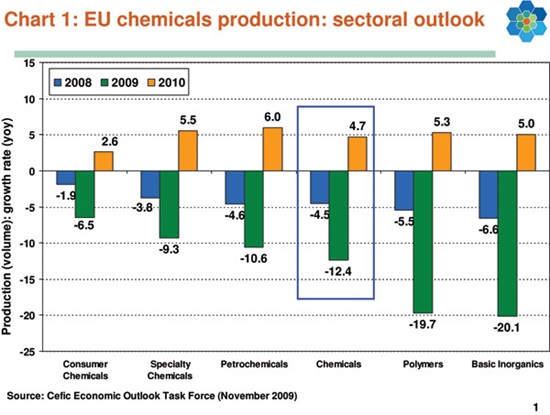

All major sectors will register sizeable declines, according to Cefi c’s economic outlook task force. The worst hit will be basic inorganics and polymers, with 2009 production forecast to plunge by 20% in response to sharp falls in demand from key consumer markets, such as automotive and construction.

Petrochemicals output is expected to be down by nearly 11% – another victim of serious recession in the building and motor vehicle sectors. Cefic expects bulk chemicals production to have ended the year down 12%, followed by specialities at 9% and consumer chemicals 6.5%.

Having fallen the least in 2009, Cefic expects European consumer chemicals output to expand more slowly this year than any of the other five major chemicals sectors. It sees consumer chemicals production expanding by 2.6% in 2010, roughly half the rate of growth forecast for bulk chemicals (4.7%), basic inorganics (5%), polymers (5.3%), specialities (5.5%) and petrochemicals (6%).

These forecast production growth rates are, of course, in comparison with probably the worst ever single year-on-year performance for the European chemical industry. But they may be difficult, if not impossible, to achieve if global economic recovery falters as some economic analysts believe it could.

Cefic’s predictions of an average 5% rise in European chemicals output this year assumes world GDP growth of 2.2%, led by emerging Asia with 6.3%, South America (2.5%) and North America (1.9%).

Perhaps mindful of its failure a year ago to fully appreciate the global recession’s impact on European chemicals demand, Cefic’s forecast for 2010 is littered with caveats and assumes no ‘double dip’ setback. ‘Risks to this forecast,’ it says, ‘come mainly from the still uncertain macroeconomic environment... particularly governments’ timing of withdrawal of economic stimuli. The speed of improvement in credit availability from the financial sector is also unknown.’

Cefic also acknowledges that global economic recovery so far has been highly dependent upon coordinated government support, which has been made available only at the expense of vast increases in public debt. ‘In order to prevent this running out of control, governments will soon need to reverse the outflows and rebuild their own financial stability. The timing of the changes in policy will need to be finely judged in order that the recovery is not put in jeopardy, while avoiding the need for an even harsher correction.’

A small indication of how such policy changes might adversely affect the European chemical industry in 2010 came in December 2009, when the UK government announced in its pre-Budget statement proposals to increase national insurance payments as part of plans to reduce spiralling public debt. The rise in taxes, while far short of the measures required to have any substantial impact on Britain’s massive public debt, was immediately denounced by UK manufacturing industry as unhelpful.

The CIA decribes the tax as ‘another impediment to companies looking to make the most of the improving economic outlook’. However, it did welcome government moves to encourage investment in biotech and pharmaceutical research, and to spend £20m on the Wilton International site, Teesside, in support of competitiveness and employment in chemical businesses.

Threats to European chemical industry recovery

The threats to European chemical industry recovery are not, however, limited to regional economic growth and fiscal policies. Cefic noted that ‘a downside risk specific to the chemical industry concerns the build-up of new petrochemical capacity, particularly in the Middle East, and what proportion of its output might find its way into European markets’.

LyondellBasell, the global polyolefins major that filed for Chapter XI bankruptcy protection a year ago, has already begun to mothball European plants in anticipation of a worsening in world over-capacity for polypropylene and polyethylene. The company also warns that further industry polypropylene capacity closures in Europe are likely as additional Middle Eastern units come onstream.

Continued access to competitively priced feedstocks plus a plunge in world freight rates continues to underpin growth in Middle Eastern chemicals production and thus raise the threat it poses to higher-cost European and US producers.

The partial collapse of the property market in Dubai and the serious debt problems afflicting Dubai World and several other governmentbacked companies in the small Gulf state have underlined the potential fragility of Middle East economic expansion, especially where unsupported the petrochemicals expansion in the Middle East is aimed at Asia where economic demand has remained relatively robust, albeit down significantly on 2007. ‘China, where the government has injected huge sums to maintain growth, has led the way after little more than a brief pause,’ says Cefic.

This view is endorsed by BASF, the world’s largest chemicals company by revenue. ‘Positive impulses are coming from Asia, above all from China, as well as from parts of South America,’ it says in its outlook following the release of third quarter financial results. But BASF warns that although company fourth quarter operating income before special items is likely to be up on the corresponding period of 2008, it will be lower than July to September 2009. Looking ahead to 2010: ‘It looks as though the worst is behind us,’ says chairman of the board of executive directors Juergen Hambrecht: ‘We expect to grow compared with 2009. The recovery will be slow and uneven.’

The American Chemistry Council (ACC) believes that the chemical industries of emerging nations will increase output by 6.9% in 2010 and 7.6% in 2011 and 2012. ‘In contrast, the chemical industries of the developed nations will average only 3.3% in the 2010-2012 period as there will be headwinds from rising production capabilities in the emerging markets in addition to anaemic growth in domestic demand.’

The ACC reckons the US will enjoy some of the strongest growth among developed nations, aided by the weaker dollar and lower natural gas prices. It sees US chemicals production, including pharmaceuticals, rising by 3.4% by volume this year following an estimated drop of 6.2% in 2009 when even pharmaceuticals output declined, by 1.1%. US chemicals output excluding pharmaceuticals is forecast to expand by 3% during 2010, with most major sectors sharing in the recovery.

Total output including pharmaceuticals is expected to grow by 4% in 2011 – 3.3% for chemicals alone – rising to 4.2% (3.4%) in 2012. However, the ACC says it may be some time before growth in all sectors is close to long-term averages. Pharmaceuticals output is predicted to overtake its past peak in 2011, with consumer products passing this recovery milestone a year later. ‘The other segments, however, may take longer.’

US capacity utilisation slump

Total US chemicals capacity utilisation slumped to just 70.1% in 2009 as plunging demand and industry destocking haunted the market. Operating rates are expected to recover to 72.9% in 2010, 75.7% in 2011 and 78.5% in 2012, assuming only small capacity additions and strengthening production volumes.

The ACC’s forecast assumes a rise of 2.6% in US GDP in both 2010 and 2011, rising to 2.8% in 2012. But it also acknowledges that the moderate growth expected in chemicals output depends on strengthening domestic demand and a continuing rise in exports. Both of these assumptions could be severely dented if the US economy suffers a ‘double dip’ and a weak world economy hits export demand.

In common with Cefic, the ACC is also acutely sensitive to the possible adverse impact of new production capacity in the Middle East. It warns that a portion of this new capacity might displace American exports and even capture some of the expected rise in US domestic demand.

Most, if not almost all, of the risks to the modest recovery being forecast for the global chemicals industry are on the downside. And few industry observers expect 2010 to pass without a few more major casualties among companies that overstretched themselves during the period of plentiful credit and were left struggling as demand and loans dried up.

A huge structural shift in the global chemical industry has seen the Middle East and other feedstock-advantaged areas consolidate their grip as price setters. It has also seen Asia emerge almost unchallenged as the key driver of major growth in chemicals demand.

In both Asia and the Middle East, and, to a lesser extent, Russia, there are companies, predominantly state-backed, ready to continue expanding their spheres of influence by buying stakes in established Western chemicals firms weakened by the economic slump.

The forecast recovery in global chemicals markets is unlikely to come quickly enough or strongly enough to weaken or reverse this trend.