Before the economic crisis, raw material prices knew only one direction: up. And as for how high they were headed, the sky seemed to be the limit. Now the situation has changed. No one seems to know when or in which direction raw material prices will go. They go up and down without any discernible pattern.

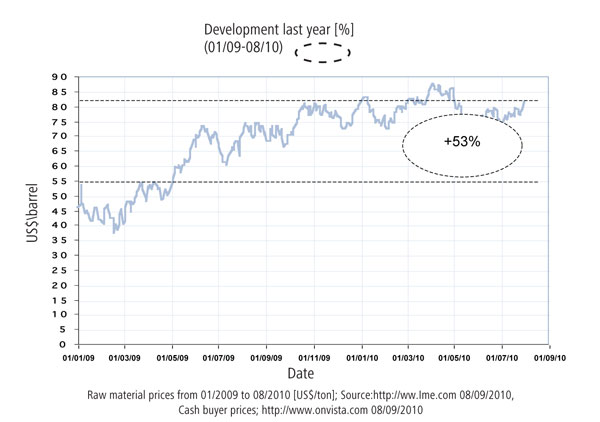

At the base of many value chains, the price of crude oil is a significant cost driver. Growing to over $140/bbl in July 2008, it fell to $37/bbl in only seven months. Since then the price has recovered to around $75/bbl. The recovery has been all but predictable and accompanied by intermediate price decreases of up to 20%. Similar effects are observed for polyethylene (PE), polypropylene (PP) and other raw materials, though each of these raw materials has its own dynamics and amplitude.

Companies have a hard time correctly judging the risk of strongly fluctuating raw material costs. If they pass on increasing costs only minimally, with a delay or too conservatively, or if increasing raw material costs coincide with decreasing sales prices, a margin squeeze is inevitable.

Highly fluctuating raw material costs and ineffective price management can greatly endanger a company’s success. The German chemical major Bayer, for example, expects a loss of approximately half a billion Euros in 2010 due to higher raw material costs. A price difference of £25/t for the remaining capacity of the year is enough to cause either a small profit gain or a huge loss.

How do business leaders assess the current market situation? Do volatile raw material costs pose a danger to economic recovery? What determines spikes and trends in raw material prices? In a recent survey of Fluctuating raw material prices, experts from strategy and marketing consultancy Simon-Kucher & Partners asked over 250 European managers from the chemical, construction and base material industries these questions.

Faced with this increasing volatility, companies must move away from rigid and fixed pricing systems. Annual contracts, for example, are no longer appropriate or up-to-date with the currently volatile raw material cost developments. In fact, 70% of managers in our survey confirm this. Moreover, 80% of respondents are sure that the elimination of annual contracts will further exacerbate the price dynamics. In a dynamic market and cost environment, shorter terms – quarterly and monthly prices instead of annual contracts – allow companies to quickly and accurately assess the price opportunities and adapt prices accordingly. The gap between contract and spot prices should then start to decrease. Half of the respondents feel that shortening the negotiation cycles and moving away from annual contracts will not necessarily lead to higher prices.

Yet 62% of the managers are of the opposite opinion. They feel that the price formulae do work as an effective means of overcoming cost and price dynamics. This percentage is particularly alarming: formula pricing in fact turns active price management into passive pricing-by-the-rules. A recent case from the steel industry reveals how price formulae are not necessarily the cure-all: to increase long-term customer loyalty, major steel producers wanted to continue negotiating annual contracts – but with formulae. Most buyers fought this, preferring to retain fi xed prices in their contracts.

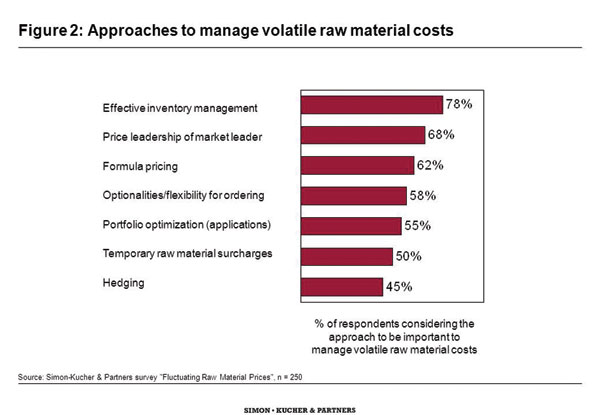

There must be other solutions. But what are they? Inventory management, according to 78% of the respondents, is seen as the most important means of dealing with raw material cost fl uctuations. In addition, 68% of the managers, the base material producers especially, feel that active price leadership on part of the market leader is another important solution. Contract options – regarding dates, volume, standards, fees etc – are seen by 58% of managers in our survey as important. Only every second respondent considers surcharges as a means of managing cost and price dynamics.

Three recommendations

Assessing the current raw material situation, including potential measures and approaches, leads to three conclusions and recommendations:

- The increasing dynamics and fl uctuation of raw material costs, along with the tendency to shorten contract terms, require more effi cient dynamic price management from a company. Pricing processes must become faster, more transparent and more effective in reacting to changing market environments. Simple and clear pricing guidelines help to overcome the complexity of pricing. After all, not only do the monthly or quarterly contract negotiations and the cost dynamics determine the price, so do other factors: the customer size and negotiating power, the order behaviour of customers and the customer value.

- The higher requirements also demand that companies are able to forecast supply and demand developments and that market-leading companies practice active price leadership. Price forecasts are diffi cult and not always 100%, but they are not impossible. An educated guess based on an expert system is always preferable over a subjective decision based on gut feeling. This is especially relevant for market leaders who set the market tone and have to possess strong pricing competence and expertise.Price formulae are not cure-alls. Initiating and setting price changes should not be based solely on escalation clauses. This is the responsibility of management, which should review the options of time-restricted surcharges as price-relevant factors.

- Price formulae are only recommended if raw material costs are the main or sole price driver. If all cost factors cannot be objectively assessed and indexed, then the terms of buying and selling cannot be properly matched. If other factors like inventory, demand or customer behaviour are the primary price drivers, then price forecasts or decision support models would improve the price setting process. Initiating and setting price changes is a key component of price leadership strategies.

Fabian Braun is a partner of strategy & marketing consultant Simon-Kucher & Partners and head of the Chemicals & Construction competence centre in Zurich, Switzerland, and Christopher Moxon is a senior consultant in the Construction and Chemicals competence centre of Simon-Kucher & Partners Strategy in London, UK.