The patient may be out of intensive care, but is still some way from making a full recovery and may have to accept that further progress will be slow. This could easily be a doctor’s considered opinion of Europe’s fragile chemicals industry following a year in which it is expected to record, just, double digit growth in production output following more than two years of traumatic contraction.

But the prognosis is hardly rosy, with the European Chemicals Industry Council (Cefic) forecasting a sobering return to low single-figure output growth this year and perhaps several more below par years before production returns to pre-crisis levels.

Cefic’s recent track record in forecasting European chemicals production, however, has left much to be desired. Two years ago, Cefic predicted that EU chemicals industry output, excluding pharmaceuticals, would decline by just 1.3% in 2009. It actually fell by 11.4%, compared with 2008. In early winter of 2009, Cefi c forecast a 5% rise in chemicals production. This was revised sharply upwards in June 2010, when 2010 output was predicted to grow by about 9.5% over 2009.

Cefic’s third quarter chemicals trends report shows that production in September 2010 was up by 6.5%, compared with the corresponding period of 2009, and nine months output grew by 12.2%. Moncef Hadhri, Cefic chief economist, says the September fi gures confi rm the overall improvement in the European Union chemicals sector. ‘The data also suggest that the recovery of the EU chemicals sector will continue in the coming months at a slower pace, with differences in EU countries and chemicals sub-sectors.’

Cefic concedes that overseas demand was the main driver of recovery in European chemicals output last year. Domestic demand, although much improved, remains short of pre-crisis levels. The latest data show the pace of growth in Europe slowing in 2010 as government economic stimulus fades and underlying demand takes over. Emerging markets, however, continue to see strong growth rates.

Cefic says sharp fiscal tightening by EU member states, very strong increases for several types of raw materials and fluctuations in the value of the euro remain sources of uncertainty. In non-EU countries, economic policies, including current US monetary policy, could provoke asset bubble fears in other countries. If emerging economies, including China, curb their rapid growth, demand for European goods, including chemicals, would ease, it cautions. Moreover, it adds that strong economic activity in Asia is currently driving up commodity prices, notably of oil, and destabilising price spikes are possible.

Cefic points out that the European chemical industry has undertaken further streamlining of its operations due to the severe recession. It maintains, however, that export growth in the second quarter indicates these efforts have worked. Nevertheless, global competition remains fi erce as Middle East capacity increases, the relentless expansion of Asian producers continues and companies in the US enjoy relatively cheap shale gas feedstock.

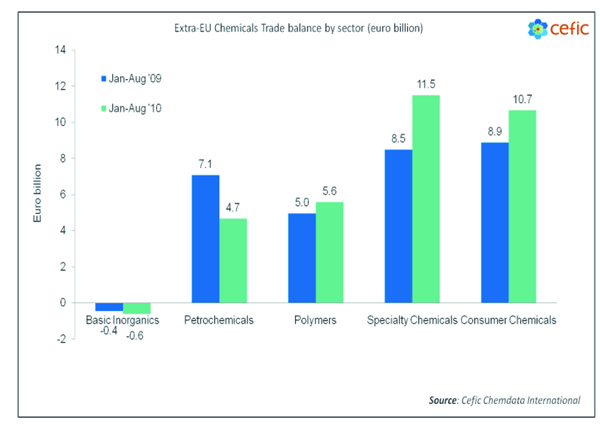

Cefic’s recently appointed new president Giorgio Squinzi concludes: ‘[European] Companies have done their homework, have made adjustments and continue to grow output. In the first eight months of 2010 this enabled Europe’s chemical industry to post a trade surplus of €32bn and a €42.6bn global trade surplus in 2009.’ However, he warns that competitive pressures, especially from overseas, will make it more important than ever for policymakers to set the right framework conditions in Europe and to reduce unnecessary regulatory burdens, which would help European industry grow their businesses.

This may have been another thinly veiled reference to the European Union’s Emissions Trading System (ETS) and its expected impact on European chemicals plant capacity and competitiveness. The Association of Petrochemicals Producers in Europe (APPE), a Cefic affiliate, has been warning for some time that cracker economics will be badly affected by Europe’s policy to curb carbon emissions. It has argued that the cost of purchasing carbon emission permits threatens up to 10% of Europe’s existing crackers and may further weaken the economics of investment in new crackers, when compared with options outside the EU.

APPE has for some time been an outspoken critic of the EU’s industrial development policy, which it has argued lacks sufficient incentives to encourage the huge sums needed to invest in new world-scale crackers. Any significant and imminent contraction in cracker capacity would, of course, have implications for Cefic’s expectations for 2011.

In June 2010, Cefic forecast a 2% rise in European chemicals production for 2011. At its annual economic outlook presentation, this forecast was raised, although only to 2.5%. This revised forecast may, at first glance, appear unduly pessimistic – especially when set against the scale and pace of European industrial recovery in 2010. But Hadhri has been quick to point out that the improvement in 2010 was from an extremely weak base. Indeed, by the end of last September, aggregate EU chemicals sector output in 2010 was still 5.6% below the preeconomic crisis production levels achieved in 2007.

Cefic is, nevertheless, constantly reviewing its forecast of chemicals output growth in 2011 in the light of both 2010 actual performance and rising economic and financial uncertainty in the eurozone and elsewhere in Europe. It concedes that the chemicals sector remains vulnerable to further economic shocks of the type that in 2010 obliged the EU and International Monetary Fund to grant a €110bn loan to Greece in May and agree a €85bn bail-out package with the Irish Republic in November. Moreover, the EU’s senior finance ministers ended 2010 preparing for the strong probability of having to mount a similar a rescue deal for Portugal, with Spain and Italy – the two remaining so-called PIIGS – lurking cap-in-hand in the wings.

The sovereign debt crises in Greece and Ireland and the reluctant rescue deals forced on the EU have further exposed fault lines between Germany and other member states. In turn, they have exacerbated the domino effect in euro bond markets as traders switch their focus to the next perceived weakest euro zone economy. This has further undermined the euro’s value on world currency markets and could, if this trend is sustained, have serious implications for the dollardenominated cost of chemicals raw materials. Cefic has warned frequently that access to raw materials and energy at globally competitive prices remains a prerequisite for a successful and sustained recovery across Europe’s chemicals industry. With the price of crude oil last month hovering close to a two-year high of around $90 a barrel and the euro under almost constant pressure, Cefic’s warnings have an almost Cassandra-like tone.

A weak euro, however, is a two-edged sword; forcing up dollar and other strong, non-euro costs at the same time as increasing the competitiveness of euro-denominated exports.

But with increasingly relentless competition from the Middle East and Asia, there seems little doubt that 2011 is most unlikely to be the year that European chemicals output recovers to pre-2008 levels. Cefic concedes that it could take several years more before production and capacity utilisation levels return to the halcyon days of 2006 and 2007.

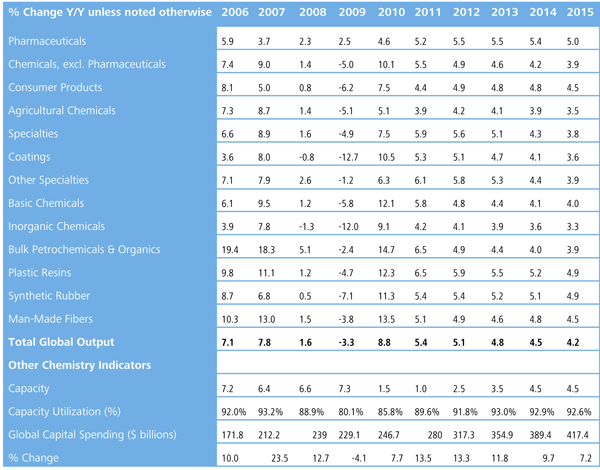

Indeed, there is a growing realisation among chemical industry observers that Europe’s route to sustained recovery and a return to pre-2008 levels of output could be both bumpier and longer than feared. Cefic’s forecast of 2.5% growth this year in European chemicals output, excluding pharmaceuticals, is broadly in line with the figures released in December 2010 by the American Chemistry Council (ACC). Its forecast, which includes pharmaceuticals, puts Western Europe output growth at 3% in 2011, dropping to 2.7% in 2012 and 2.6% in 2013.

The ACC forecasts that output from emerging Europe, which includes Russia, will rise by 11.1% this year after a 13% increase in 2010. However, it then sees emerging Europe’s chemicals production halving to just 5.6% in 2012, due to a forecast collapse in Russian output growth from 17.9% in 2011 to only 5% in 2012.

Asia’s seemingly unstoppable upward growth path will continue, according to the ACC. However, total Asia-Pacific chemicals production growth is forecast to decline from an estimated 12.9% in 2010 to 8.4% this year and 8% in 2012.

All major producers are expected to experience declines in output growth this year, with the most marked being in Singapore, Taiwan, Korea and Japan. Even the Asian chemical powerhouse of China will see some curb in its expansion rate, according to the ACC. China’s output growth will slip from a forecast 16.8% in 2010 to 13.1% in 2011 and 11.9% in 2012. India is the only significant Asian chemicals producer to buck the trend, with an expected rise in output of 8.3% this year, down only marginally on the estimated 8.5% rise in 2010. The ACC then expects Indian production to grow by 8.8% in 2012.

Africa and Middle East chemicals production recovered strongly in 2010, with estimated output growth of 9.7%, compared with 2009. This year, the ACC forecasts that growth will ease to 6.6% and rise only marginally to 6.7% in 2012. A similar recovery curve is seen for Latin America, where chemicals production growth is put at 5.5% this year following an estimated 7.1% rise in 2010. Growth in 2012 will be maintained at 5.5%.

BASF, the world’s largest chemical company by sales revenues and increasingly a bellwether for global as well as European chemical industry trends, expects to continue its record-breaking performance this year. And its performance as well as its financial forecasts and general expansion strategy can be useful yardsticks if not proxies for performance in the world’s most robust chemicals regions.

Chief executive Jürgen Hambrecht has forecast 2010 earnings before interest and tax of more than €8bn on sales of €63bn, and aims to improve profits further this year while growing sales by two percentage points above chemical market growth. Although never entirely insulated from fluctuations in key exchange rates, BASF’s policy of major capital investment in substantial new capacity in China and elsewhere in Asia has shielded it from the adverse effects of major currency movements. As Hambrecht points out, BASF’s major growth markets coincide with areas where it has invested in new production centres, thus virtually eliminating the group’s exposure to major currency transactions. It still faces currency translation issues but with the euro on a downward curve and likely to remain so while sovereign debt crises stalk the EU’s weaker economies, they promise to boost not deflate BASF’s euro denominated results.

BASF’s long-term policy of investment in emerging markets, especially Asia, has been fully vindicated. As Hambrecht pointed out when commenting on the group’s third quarter results, some 60% of the chemical industry’s current growth is in Asia.

The company’s shrewd acquisitions policy and ruthless pruning of under-performing assets, which offer no long-term strategic benefit, has also helped maintain BASF’s position as global chemicals leader.

Its latest major acquisition, the German specialty chemicals company Cognis, has been well-timed. Cognis, which BASF bought for just over €3bn, achieved a near doubling in its first nine months operating profits on sales up 18% in 2010.

If the European chemicals industry as a whole ever comes close to emulating the performance of its largest chemicals company, then the recovery will be complete, albeit something of a miracle.

Neil Sinclair is a freelance journalist based in London, UK.