All products pass through a ‘maturity cycle’, proceeding from market formation to market growth to market commoditisation. The company or companies that create a new market reap more financial benefits than companies participating in its commodity phase. This bit of business acumen is not new; however, the difference between historic times and the present is how fast markets commoditise.

To compete in the new global market, chemical companies must reduce cycle time for process/ product development. Cycle time is the period between idea inception and product sales; reducing it requires a multi-facetted strategy, which includes non-traditional development procedure, concurrent engineering and contract or contract manufacturing. Traditional process/product development silos each scale. In other words, work is completed at a given scale before proceeding to the next larger scale: laboratory, demonstration unit, pilot plant, semi-works and commercial plant. This approach requires too much time and money to be successful in today’s global market.

The alternative approach of overlapping scale silos requires using contract manufacturing facilities when a chemical company attempts to develop a particular process/product quickly or to develop several processes/products simultaneously. Since the early 1990s, R&D facilities have been ‘downsizing’ in the never-ending quest by corporate management to boost earnings. Many chemical companies no longer possess pilot plant resources, either staff to design them or personnel to build and operate them. Also, many chemical companies no longer have the resources to develop more than one process/product ‘in-house’. Some chemical companies no longer attempt to develop a process/product in-house and use contract manufacturing because it reduces cycle time.

Contract manufacturing

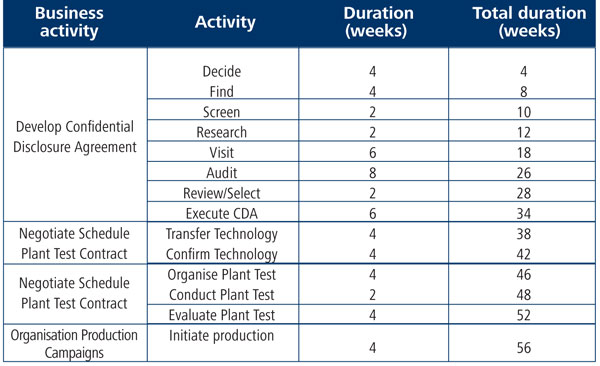

Going down the contract manufacturing route involves a number of operations. The contracting company must identify potential contractors, screen them, research them, visit them, select one, execute a Companies can get their products to market quicker by using contract manufacturers to carry out different process operations simultaneously, writes Jonathan Worstell Meeting place: the annual Informex show offers the possibility of face-to-face contact secrecy agreement, then transfer the new technology to the contractor. The contractor then evaluates the technology. The contracting company and contractor then negotiate a commercial scale; that is, plant, trial contract, organise the plant trial and conduct the plant trial. Following a successful plant trial, the two companies negotiate a commercial contract.

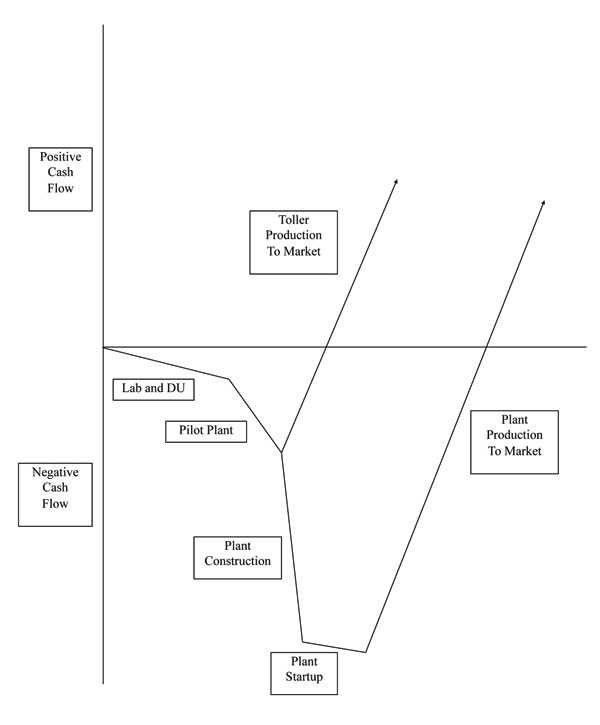

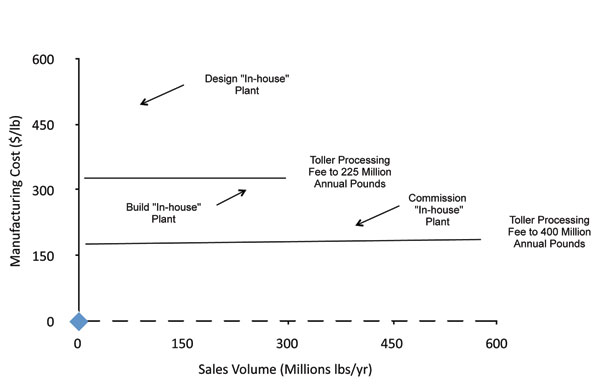

When deciding to use a contractor, the contracting company must determine whether it wants to expose its new process/product to a wider audience and what is the financial benefit and risk of such exposure. If the contracting company has a strong patent position vis-à-vis the new process/ product, then contract manufacturing is a viable option. If not, then it may not be appropriate. contracting company should do a cash flow analysis (Figure 1), a sales volume breakeven analysis, and a capital investment timing analysis (Figure 2). A cash flow analysis shows how quickly contracting can achieve positive cash flow compared with in-house process/product development. Recasting the cash flow analysis in terms of sales volume required to breakeven provides an indication of the risk involved between development routes: the larger the required breakeven sales volume, the more ‘at risk’ the investment becomes. Finally, plotting estimated unit manufacturing cost against time shows when an in-house plant should be built, commissioned and operated.

Having decided to use contract manufacturing, the contracting company must find a contractor. Potential contractors can be identified via the Internet at www.chemicalinfo.com, a pay-to-use service, or www.icis.com/search, a free service. The annual Informex show lists potential contractors and provides a meeting point for face-to-face contact.

The resulting list must be screened by teleconferencing to confirm the chemistry performed by each contractor and the equipment available at each contractor’s site. The contracting company must next research the financial stability and environmental and safety compliance records for contractors surviving the screening step. Knowledge of the financial stability of a contractor is important; otherwise, halfway through a project, the contractor may announce imminent closure or ask for more cash to remain open to complete the project.

Personnel from the contracting company must visit the potential contractors surviving the financial and environmental/safety investigation. This visit is done before executing a secrecy agreement; thus, discussions will be general. The purpose of this visit is to confirm and inspect off-loading and loading facilities, pertinent operating equipment and laboratory facilities for analysing feed and product streams, as well as for solving process chemistry issues that will arise during startup and production. Observation of ‘housekeeping’ is important since it and safety are closely related. Another purpose of this visit is to gain an impression of the contractor’s staff with regard to competency: will they help or hinder solution of the process issues arising during startup and production?

Following the pre-secrecy agreement visit, the contracting company will audit the contract manufacturing facility, covering cover safety, environmental and product safety compliances. This step incurs significant expense for both companies. The safety audit concentrates on US Occupational Safety and Health Administration (OSHA) inspection records and citations, and reviews the hazards communication, industrial hygiene and personal protective equipment programmes, as well as the emergency response plan for the site. The environmental audit covers: Does the contractor have an environmental group?

Does the contractor perform internal audits and conduct training?

Is the contractor in regulatory compliance? The product safety audit covers the contractor’s ability to issue ‘Certificates of analysis’; label product properly; and ensure against feed and product contamination.

Limiting liability exposure is the guiding principle in selecting the contractor. Waste disposal incurs the greatest liability for the contracting company. Inappropriately handling, shipping and disposing of a waste stream can initiate criminal and civil legal action. Thus, the contracting company needs to specify, in all contracts with the selected contractor: how to manage any resulting waste stream, who will transport the waste, and who will dispose of it.

Once a contractor has been selected, the contracting company then initiates discussion concerning the bounds and conditions for transferring technology to them. This discussion produces a secrecy agreement which, in essence, says that the contractor will not broadcast, for a specified time period, any information concerning the process/product being developed. This agreement is a product of the legal staffs of both companies. As such, it can be a short, simple document achieving quick ratification by all parties, or a long, complex document obtaining no consensus. With these outcomes in mind, the contracting company should begin writing a template secrecy agreement well before reaching this step.

Upon signing the secrecy agreement, the contracting company transfers the technical information pertinent for their project to the contractor for evaluation. The technical information should be presented in a seminar format, allowing direct questioning, and in a written format, called the process definition. The transfer should also include safety, environment, storage and shipping information, as well as information about waste control.

The contractor’s staff evaluates the technology following its transfer. This occurs at the laboratory scale and the pilot plant scale, which confirms yield and purity information. In addition, the pilot plant experiments show whether the process is reaction rate or mass transfer rate limited with increasing scale. Safety information is confirmed at both scales; in particular, the heat transfer coefficient for the pilot plant scale should be determined and compared with that of the commercial scale equipment to guard against catastrophic heat accumulation in the reacting volume. With this information, the contractor can decide if it can do a commercial scale trial safely and successfully.

The ensuing negotiation for a commercial scale trial occurs between business centres, with occasional input from the appropriate technical group. All contractors realise their business is competitive; their bids have to be accurate and competitive; otherwise, the customer will find a different contractor. On the other hand, contracting companies need to remember that high temperature, high pressure, or multiple step processes produce bids that seem high. One way to overcome such ‘sticker shock’ is to do a cost estimate for developing the process/ product in-house. In most cases, this estimate for developing the process/product in-house will be higher than received bids from contractors.

The setup and cleanup fees inflate the bid for a commercial scale trial because, by definition, such a trial is a ‘one off’ production campaign. The contractor reverts to established production following the trial while the contracting company evaluates the information from the trial. If the process/product goes into production, many kilos/pounds will be produced per setup and cleanup, thereby lowering the processing fee. During this negotiation, the contractor should specify setup and cleanup fees, specify processing fees and specify any special fees likely to be incurred.

Organising the commercial scale trial occurs during contract negotiations. This production trial is pre-commercial: no market yet exists or the contracting company is entering a market in which they are not participating. Thus, the trial will be fully supported by technical staff from the contracting company. They will coordinate the flow of information and production inputs between the two companies via the contractor’s technical staff. This organisational scheme facilitates the rapid identification of startup and production issues and their formulation in a technical language that leads to resolution.

While this organisation is appropriate for the commercial scale trial, it should be modified once the product is ‘commercial’, which generally occurs after the second or third commercial scale production campaign or when the contractor shows complete competence with regard to operating the transferred technology. At this point, the technical staffs should be removed from the daily operation of the process, thereby allowing the business groups and production group to manage production to meet market requirements. There are several reasons for this reorganisation. First, it is expensive for the contracting company to maintain technical staff at the contracting facility. Second, technical staffs search for problems to solve, and find them, even when production is proceeding smoothly. Third, the technical staffs form a communications channel that can generate significant noise that can cause confusion within the rest of the organisation. For these reasons, it is best to redeploy technical assets as quickly as possible following the commercial scale trial.

Jonathan H. Worstell is an independent consultant specialising in contract manufacturing, process chemistry and scale up, based in Richmond, Texas, US.