As the world looks for ways to keep global warming in check, hydrogen is in the spotlight as a green energy option. Maria Burke explores whether hydrogen’s time has come

The ‘clean energy economy’ has been talked about for years but never seems to have arrived. Most energy for transportation, heating and cooling, and manufacturing is still delivered using fossil fuels. Now it seems that hydrogen may be about to fulfil its potential as a commercial fuel as governments increasingly offer more support and industry moves toward greener options.

Hydrogen can be used to produce electricity or fed into fuel cells to run cars or power plants. It also offers a potential alternative to current fuels used by the biggest greenhouse gas emitters, the long-haul transport, steel-making and cement industries. Its major attraction is that when burned or used in a fuel cell, the only byproduct is water. So, if hydrogen could be produced from domestic energy sources economically and in an environmentally friendly way, then it would reduce dependence on fossil fuels as the major sources of energy and improve environmental quality by lowering carbon emissions.

Around 120m t of hydrogen are produced every year, according to the International Energy Agency (IEA). About 5% is a byproduct of chlorine generation by electrolysis, but most is produced from natural gas and coal. In a process called steam methane reformation, ‘grey’ hydrogen and carbon dioxide form when steam is reacted at high pressure with hydrocarbons. When carbon emissions are captured during this process, it is called ‘blue’ hydrogen. Blue hydrogen is also produced, together with solid carbon, when natural gas is combusted at low pressure and high temperature in the absence of oxygen: thermal methane pyrolysis. ‘Green’ hydrogen is produced when electrolysis is used to split water using renewable energy. Currently, the world makes very little green hydrogen (0.1%) of the total 120m t.

|

"2020 marks the beginning of a new era for energy as the potential for hydrogen to become part of our global energy system becomes a reality. A clean energy future with hydrogen is closer than we think because industry has been working hard on addressing key technology challenges" Benoît Potier CEO of Air Liquide and Co-chair of the Hydrogen Council |

Has hydrogen’s time come?

There have been false starts for hydrogen in the past, but the IEA believes this time it could be different, thanks to the recent successes of renewables. With a global energy sector in flux, the versatility of hydrogen is attracting stronger interest, and the number of policies and projects is expanding rapidly, it says in a report: The Future of Hydrogen: Seizing Today’s Opportunities (iea.org/events/the-future-of-hydrogen-seizing-todays-opportunities).

‘Hydrogen is today enjoying unprecedented momentum, driven by governments that both import and export energy, as well as the renewables industry, electricity and gas utilities, automakers, oil and gas companies, major technology firms and big cities,’ says Fatih Birol, Executive Director of the IEA.

Benoît Potier, CEO of Air Liquide and co-chair of the Hydrogen Council, a global coalition of energy and transport companies, agrees: ‘2020 marks the beginning of a new era for energy as the potential for hydrogen to become part of our global energy system becomes a reality. A clean energy future with hydrogen is closer than we think because industry has been working hard on addressing key technology challenges.’

There are certainly signs that hydrogen’s time has come, remarks Bert van der Toorn, Global Lead & Regional Head Mid/Downstream Oil & Gas at ING, the Dutch bank, which finances renewable energy projects and advises businesses in the energy sector. ‘In order to reduce CO2 emissions, hydrogen has to be considered seriously as an alternative for replacing grey hydrogen, high-temperature industry heating, long-term storage of renewable energy and long-haul transportation of trucks, trains, vessels and even planes.’

But the widespread adoption of hydrogen still faces significant challenges. If the private sector is to invest, says van der Toorn, it requires decent physical infrastructure; stable regulatory regimes that stimulate and support investments; and stable subsidy, pricing or taxing of externalities, eg CO2, that will allow investors to make an appropriate return on risk.

Production costs are the hardest challenge, says Stefan Reichelstein of Stanford Institute for Economic Policy Research in the US. However, he says two trends have been significant in recent years. ‘First, renewable energy has become much cheaper. Second, with more deployments of electrolysers, another relatively young clean energy technology is coming down a learning curve that hinges on cumulative manufacturing experience. We expect this trend to accelerate, particularly if public policy provides incentives.’

This view is supported by a recent Hydrogen Council report: Path to Hydrogen Competitiveness: A Cost Perspective (hydrogencouncil.com/en/path-to-hydrogen-competitiveness-a-cost-perspective/), which shows that the cost of hydrogen solutions will fall sharply within the next decade; sooner than previously expected. As scale-up of hydrogen production, distribution, and equipment and component manufacturing continues, it forecasts costs to fall by up to half by 2030 for a wide range of applications. That would make hydrogen competitive with other low-carbon alternatives and even some conventional options.

Hydrogen could be the lowest cost, low-carbon solution in 22 of 35 cases analysed, such as in the steel industry and heating for existing buildings, the report finds. And it can beat fossil-based solutions in nine cases, for example, in heavy-duty transport and trains. According to the report, scaling up has produced big cost reductions in making blue and green hydrogen, distribution and refuelling, and components for end-use equipment. The report stresses, however, that ‘supporting policies will be required in key geographies’, plus investment of about $70bn as 2030 approaches.

|

€18m |

|

As scale-up of hydrogen production, distribution, and equipment and component manufacturing continues, costs are forecast to fall by up to half by 2030 for a wide range of applications. That would make hydrogen competitive with other low-carbon alternatives and, in some cases, even conventional options |

Surplus energy

Hydrogen contains up to three times more energy per unit mass than diesel, and 2.5 times more than natural gas, which makes it useful for storing excess generated energy, especially energy from renewable sources. For example, excess electricity could be used to produce hydrogen at times of low demand, then converted back into electricity when demand increases, which could boost the usefulness of renewables.

Reichelstein says his research shows that, as the share of renewable energy increases in many countries, there will be more and more times when electricity trades at relatively low prices. Electrolysers can absorb the corresponding surplus electricity in real time. Thereby hydrogen becomes an effective energy buffer that allows the gas to be used for industrial and transportation purposes, or alternatively to be converted back to electricity at times when renewable power generation falls short.’

So, is there a business case for producing hydrogen using surplus clean energy? Yes and no, says van der Toorn. ‘If there is surplus clean energy freely available in constant and sufficient quantities at one particular location, one would save up to 70% of the costs of producing hydrogen, and costs could possibly be further reduced with experience and economics of scale. The resulting hydrogen would be cheap. This would, however, only be of interest if the hydrogen could then be transported to a destination that can use it. Safe and economically viable transportation of large quantities of hydrogen is still challenging, either by dedicated pipelines or vessels, as well.’

In January 2020, the Port of Ostend announced the world’s first commercial scale project to use wind power to fuel hydrogen production. The project on the North Sea coast will use wind power not absorbed by Belgium’s electricity grid and should be operational by 2025. It will serve as an energy source for electricity, transport, heat and fuel, and as a raw material for industry.

By the end of 2020, the project partners forecast 399 wind turbines will be operating off the coast with a capacity of 2.26GW. Future plans anticipate several hundred more wind turbines, boosting capacity to 4GW. ‘The wind turbines’ production peaks rarely coincide with consumer demand peaks,’ the companies said in a statement. ‘We need to be able to temporarily store our green energy surplus using hydrogen as an energy carrier or to use hydrogen as an alternative raw material for converting the industry away from fossil fuels.’

Meanwhile, in France, energy supplier Engie is running a green hydrogen demonstration project (GRHYD) with funding from the French government. Production will be based on energy from wind power injected into the power distribution network. A residential neighbourhood in Dunkirk will be supplied with a blend of hydrogen and natural gas using a variable hydrogen content of below 20%. Surplus power will be used to produce hydrogen for storage and subsequent distribution to meet demand. In addition, a bus fuelling station in Dunkirk will be adapted to handle a hydrogen/natural gas blend – Hythane – and service around 50 buses.

In 2017, the EU’s R&D programme, Horizon 2020, announced funding – €18m over 4.5 years – for the construction of one of the world’s largest electrolysis plants for producing green hydrogen. The pilot project run by the Austrian electricity company Verbund is building a plant to operate both as a fuel cell and as an electrolyser, by taking excess wind and solar power from the grid and converting it into hydrogen. The green hydrogen will be fed directly into the internal gas network, allowing the testing of the use of hydrogen in various process stages of steel production.

|

3x |

|

120m t |

Government support

It’s clear that government backing will be key to the future of hydrogen. The EU’s support, followed by legislation and implementation will be of utmost importance, comments says van der Toorn. ‘Besides supporting R&D, establishing a EU regulatory basis to incentivise and subsidise investment in hydrogen infrastructure would boost the scalability of hydrogen deployment.‘

Reichelstein agrees: ‘Support for hydrogen technologies, including fuel cells and electrolysers, possibly on a sliding scale for a number of years, will be critical. For instance, Germany grants feed-in-tariffs for renewable electricity. If such subsidies were instead granted as production premia – rather than feed-in premia – that would create effective incentives to convert renewable power to hydrogen via electrloysis.’

Germany, which takes over the EU Council presidency in July 2020, has said that establishing an internal EU hydrogen market is one of its priorities. The European Commission plans to publish a gas decarbonisation package, in which hydrogen is expected to play a key role, in 2021.

The European Green Deal, which outlines initiatives for reaching net-zero global warming emissions by 2050, includes a role for hydrogen. Priority areas include green hydrogen, fuel cells, energy storage, and carbon capture, storage and utilisation. Frans Timmermans, First VP of the European Commission, has said that he sees a pivotal role for green hydrogen in the transition to a low-carbon economy.

The Commission is reviewing eight green hydrogen projects with decisions expected this year under the umbrella of Important Projects of Common European Interest (IPCEI). The most ambitious is the ‘Silver Frog’ project which, with an investment of €12-15bn, would produce 800,000t/year of green hydrogen over eight years. This would be transported by gas pipelines to manufacturing facilities in Europe. Estimates by trade association SolarPower Europe say it could cut out 8m t/year of CO2 emissions. The partners propose to build a 2GW solar module factory to deploy 10GW of renewable energy generation capacity, including wind power.

‘The Silver Frog project reveals how solar can facilitate the development of renewable hydrogen,’ says Walburga Hemetsberger, CEO of SolarPower Europe. ‘Further, this project’s emphasis on the integration of PV manufacturing facilities sends a strong signal to the Commission that any discussions surrounding renewable hydrogen will require a robust renewable industrial strategy.’

If public policy supports the much needed early deployments of electrolysers and fuel cells, Reichelstein says his projections indicate that green hydrogen could be positioned competitively within the coming decade. Van der Toorn agrees: ‘Given the momentum hydrogen is gaining these days, ten years seems to be a long time – just look at the solar, wind or mobile phone industries.’

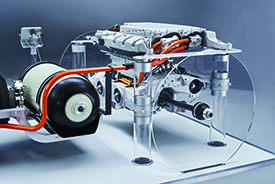

Hydrogen carsHydrogen fuel cells have some advantages over pure battery power, including much shorter refuelling times and the ability to heat the vehicle without reducing range. Some car manufacturers have embraced the technology, such as BMW, which is expected to launch its next-generation hydrogen car, based on its popular X5 SUV, in 2022. Jürgen Guldner, BMW’s VP for hydrogen and fuel cell tech, has said that fuel cells could help convert all BMW cars to zero emissions over the next two decades; and that prices could be comparable with petrol and diesel equivalents in five years. However, while hydrogen infrastructure is growing, it is still limited, according to E4Tech’s Fuel Cell Industry Review 2019 (fuelcellindustryreview.com/). In 2019, refuelling infrastructure grew in all the main early adopter regions, including Japan, Korea, California, China and Germany. But the roll-out varies by region. In Germany, one hydrogen fuelling station serves fewer than 10 cars on average. In the US and Korea, this figure is about 130. Some stations in California are visited so frequently that they can run out of hydrogen and need to be upgraded. Image: The BMW i Hydrogen NEXT will be propelled by the fifth generation e-machine, which will first be launched in the BMW iX3. The peak power battery located above the e-drive unit can supply boost power for additional dynamics which can be required when overtaking. The total system output is 275 kW. |