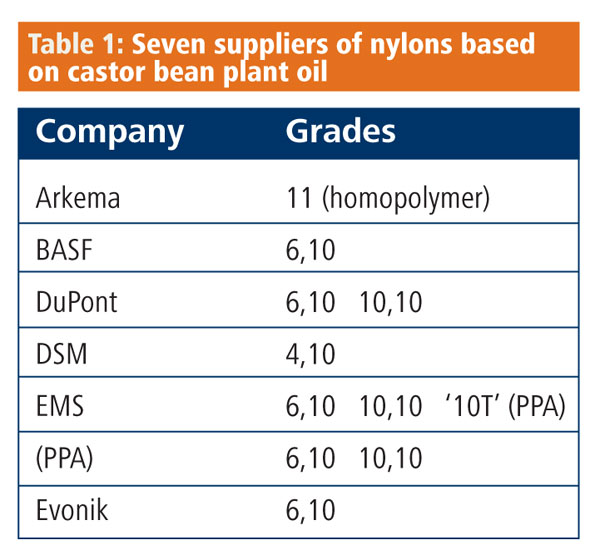

At K2010, the huge plastics exhibition this month in Germany, more than 2500 exhibitors will try to grab the attention of a quarter of a million visitors. Among their number, seven of the largest polymer suppliers – including BASF, Arkema and DSM – will each be showing a remarkably similar niche product: at least one grade of nylon or polyamide, PA, that is derived from castor oil (Table 1).

None of them are shouting very loudly about it; despite the product similarities, none are in dispute with one another. And while some are showing these grades for the first time, the technology is not even new: one supplier has been making it for 60 years, while others have rescued it from their technology archives.

In effect, it is a technology whose time has come. Three main factors have collided at the right time to bring these materials to market: a growing demand for ‘green’ materials; established production technology – the materials can be made in existing nylon facilities; and a readily available raw material, castor oil.

Once, nylon was just the material used to make stockings and toothbrush bristles. Then, it was a fibre for carpets. Now, it is a widely used engineering plastic with applications in engine compartments, cookware, electrical equipment and barrier packaging. The ability to make the material from a natural source is an attractive one for suppliers.

Making plastics from renewable resources began with cellophane, which is based on cellulose, and continues with a new generation of biodegradable plastics that use feedstocks such as corn or maize. The difference is that these new nylons are built to last. In fact, most of them are sold on the basis that they can perform better than their conventional equivalents.

In 2007, BASF introduced a castor oil-based nylon called Ultramid Balance S3K. Structurally, it is a nylon 6,10 (see Box on page 27). At the K2010 show, BASF will introduce four glass-reinforced grades of the material.

It is a difficult balancing act for materials suppliers. Their customers are demanding ‘green’ plastics – which might be recycled, biodegradable or derived from renewable sources. However, these new grades are not cheap because they are made in relatively small quantities, in processes that are not fully optimised. For this reason, the new grades cannot be sold simply on their environmental credentials. They must deliver performance improvements too.

Nylon 6,10 has better resistance to both hydrolysis and environmental stress cracking than its main established rivals nylon 6,12 and nylon 12, Scheibitz says, which he hopes will help it to compete head-on despite its higher price.

One recent high-profile application of such a material was Denso’s use of nylon 6,10 for a radiator end tank in the Toyota Camry. The Japanese component supplier used DuPont’s Zytel RS material, ensuring that the component contained more than 40% by weight of renewable content. The base resin itself has a 63% renewable content – based on the convention that only six of its 16 carbon atoms are derived from petroleum.

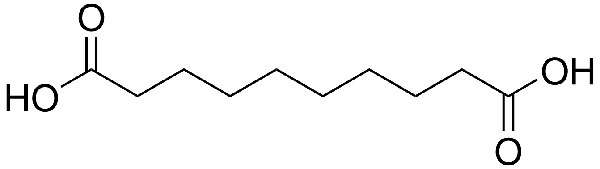

DuPont also offers a nylon 10,10 grade, which can be made completely from renewable resources: sebacic acid is converted into its diamine equivalent, which is then combined with more sebacic acid to make nylon 10,10. ‘The renewable content varies depending on the needs of the application,’ says Thomas Werner, corporate account manager for engineering polymers at DuPont. DuPont says that nylon 10,10 offers superior heat and glycol/water ageing, plus easy processability. It can be used where high chemical resistance is needed, such as in fuel and diesel lines and other extruded hoses and pipes. Other potential applications are in the air induction system, such as air filter housings.

These new products include Rilsan HT, a renewably sourced polyphthalamide (PPA), and Pebax Rnew, a thermoplastic elastomer whose two phases are nylon 11 and polyether. ‘For all of our products, the main driver is not the fact they are bio-based – it is their performance,’ he says.

Rilsan HT has been used to replace metal pipes in the engine compartment, because it has very high temperature resistance and can also be extruded into shape. At the same time, injection moulding grades can be used in moulds designed for PA11 or PA12 – so can be used in a drop-in replacement for both materials.

Away from automotive, it has developed a further grade – a version of nylon 11 called Rilsan Clear Rnew. The grade is amorphous, and therefore transparent. It has been used in spectacle lenses, such as Evolve sunglasses from Smith Optics. But Arkema will not be drawn on the subject of cost. ‘We prefer to talk about value,’ says Lacroix. ‘The process of making a castor oil-based material is a bit more complex than a standard polymer, but after that it’s about what you deliver to the customer.’

Others are more direct on the issue. ‘Because of the cost of the monomer and its limited availability, these products are all more expensive than their petroleum-based equivalents,’ says Andre Sturzel, a product manager at Swiss nylons supplier EMS-Chemie. ‘The only way to sell them is through a combination of special features and the fact it is bio-based. I can’t see the price of these types of polymer coming down. Standard polyamides are made on a very large scale, using processes that have been optimised for 50 years.’

EMS has four bio-based nylon product families in its Greenline range. The materials are: Grilamid 1S, a nylon 10,10; Grilamid 2S, a nylon 6,10; Grivory HT3, a polypthalamide (PPA); and Grilamid BTR, an amorphous, and transparent, nylon.

Nylon 10,10 cannot be used in the automotive industry because of its high cost, but is instead aimed at applications such as connectors, electrical housings and cable sheathing. ‘The key positioning is a highly reinforced polymer for housings for portable electronics devices,’ he says. For automotive applications, the firm’s nylon 6,10 is being used mainly for flexible tubes and connectors. At the top end, its bio-based PPA can withstand reflow soldering temperatures of around 260oC.

Despite the need to stress performance over sustainability, companies like EMS are working hard to prove their green claims. In time, as green issues become more important, it is likely that the balance between ‘performance’ and ‘sustainability’ may shift.

EMS has carried out life cycle analysis (LCA), including the use of energy, water and other resources, on its materials. Partly because of the sustainable nature of the monomer, and partly because it is made using energy from a biomass plant, EMS says that its bio-based nylons generate far less carbon dioxide than its conventional grades. In the case of its nylon 10,10, in which both monomers are sustainably sourced, the reduction is around 77% compared to its standard Grivory GV grade.

French nylon specialist Rhodia has carried out similar tests on its Technyl Exten, a nylon 6,10 that comprises two grades for extrusion and three for injection moulding. It says that the new grades generate half the carbon dioxide equivalent of standard PA6 or PA12 grades. And, in a neat example of energy conservation, its bio-based nylon has helped a battery manufacturer to extend the lifetime of its products by up to 50%. Rocket Electric of South Korea, one of the world’s largest manufacturers of battery cells, has used the Technyl Exten in its AA and AAA ranges of alkaline batteries.

Rocket replaced a nylon 6,6 component with Rhodia’s nylon 6,10, whose significantly higher chemical resistance helped to prolong the battery’s lifetime. ‘We aim to develop materials that help our customers to reduce their carbon footprint,’ says Jean-Pierre Marchand, R&D director for engineering polymers at Rhodia. ‘You can do this by using bio-sourced raw materials, but that is the lever rather than the objective.’

Nylon variants – a versatile condensation polymer

While polymer properties such as chain length or molecular weight can be altered, the basic structure is fixed. So polypropylene is polypropylene, and PVC is PVC. Not so with nylon, whose structure can be varied by changing the raw materials. The most common way of making nylon is in a condensation process, using a dicarboxylic acid and a diamine. When reacted together, the acid and amine will alternate to form a long molecular chain. Changing the nature of either of them will lead to different types of nylon – with different properties. The first condensation polymer was nylon 6,6, made from six-carbon adipic acid and six-carbon hexamethylene diamine (HMD). Replacing adipic acid with the 10-carbon sebacic acid from castor oil produces a new polymer called nylon 6,10. The convention for naming nylons that are made in this way is that the first number refers to the diamine, the second number to the acid. So DSM’s ‘nylon 4,10’ would be made from a four-carbon diamine and sebacic acid. Some of the properties are quite different – in particular, resistance to hydrolysis. This is the Achilles’ heel for nylons, because amine groups within the polymer react with moisture in the air. Materials with a smaller proportion of amine groups, which are those with more carbon atoms, will be more resistant. Suppliers are also working on other variants: BASF has published research on nylon 5,10; and there are plans to try and make HMD by fermentation, leading to the prospect of an all-natural nylon 6,6. ‘Castor oil is currently the only source for these types of polymers today,’ says Andre Sturzel, product manager at EMS. ‘We know there are projects to develop monomers from sugar, for example, but this in not yet available on a large scale.’

Lou Reade is a freelance science writer based in Kent, UK.